Download a copy of the study here!

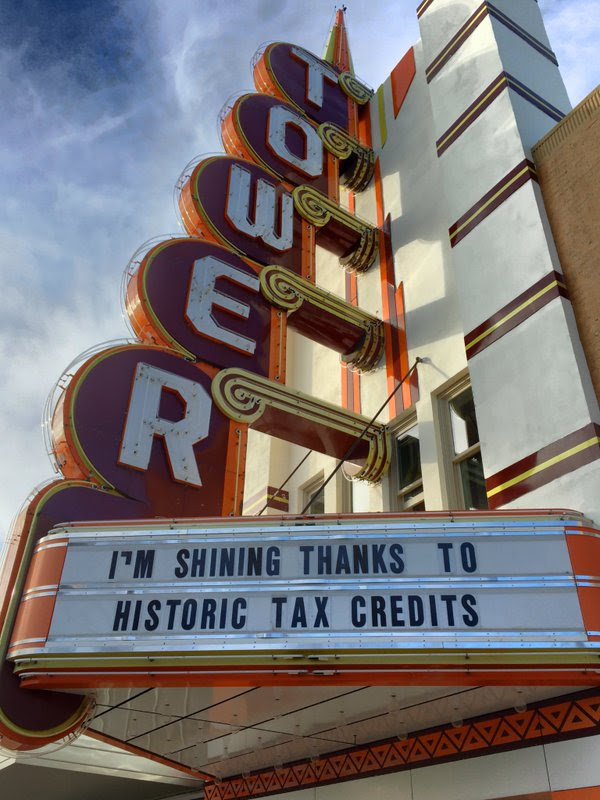

Downtown Tulsa is booming, and historic tax credits have a major part to play in its exciting revitalization! The welcome return of restaurants, retail and entertainment venues, coupled with new hotels and new living spaces, has breathed new life into the heart of our city over the past decade. More often than not, these new businesses and lofts are making their homes in old buildings. The Historic Tax Credit program is the key to successful reuse of vacant or underutilized historic structures.

Since January 1, 2006, Oklahoma’s state Historic Tax Credit program matches Federal tax credits for certified rehabilitation of historic properties. Historic properties offer a diversity of redevelopment possibilities for every investor, and each holds multiple commercial-use potentials. The tax deduction is often a crucial financial consideration for developers.

TFA understands the importance of preservation as a powerful economic catalyst for community revitalization. We recognize the need for effective tools to ensure the viability of historic rehabilitation projects. We see the impact these revitalized structures have within our community and the draw they provide to those who come to Tulsa for business and as a heritage tourism destination. However, this successful program routinely finds itself on the Legislature’s chopping block.

Tulsa Foundation for Architecture commissioned a study on the economic impact of Oklahoma’s state Historic Tax Credit program in 2016 through Place Economics, Inc. Study findings strongly support retention of the program. As a fiscally responsible tax incentive, the historic tax credit program has been remarkably successful in creating jobs, in generating tax revenues at the state and local levels, and in increasing the understanding and appreciation of the wonderful history of Oklahoma as represented in its historic buildings.

Tulsa’s success stories include the iconic Mayo Hotel and Residences; the former Tulsa Paper Company warehouse that now contains the Woody Guthrie Center and Philbrook Downtown; the Philtower Lofts; the Coliseum Apartments; and the Palace Building, among many others. All of these projects enhance and stimulate growth in our city center and have made downtown Tulsa an exciting place to be again!

· Every $1 awarded in historic tax credits spurs $11.70 in economic activity.

· The Oklahoma treasury receives more than 50% of the money back before the credit is even awarded.

· The credit has attracted investments to the state reaching $520 million.

· These projects have generated well over 3,000 jobs.